withdraw money from chime credit card

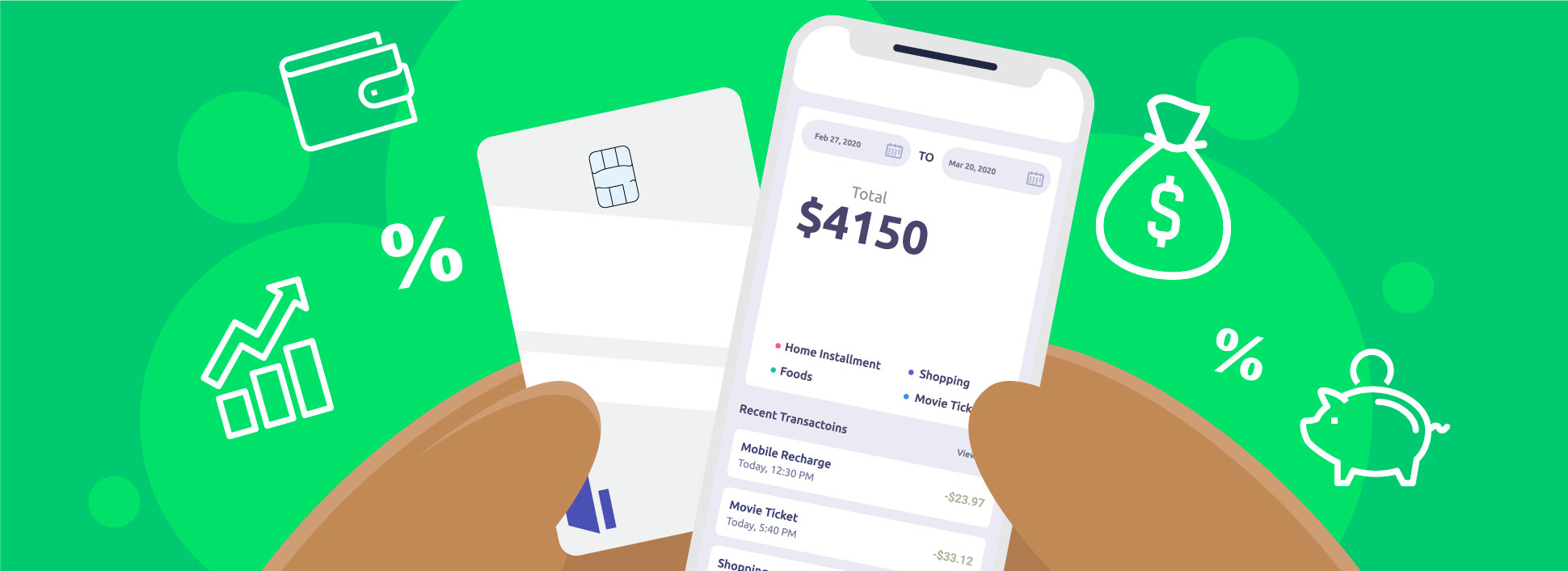

The transfer limits of Chime are about the transfers made from your external account to the Spending Account. Annual Percentage Rate APR.

How To Withdraw Money From Chime Without A Card And Other Withdraw Options Retirepedia

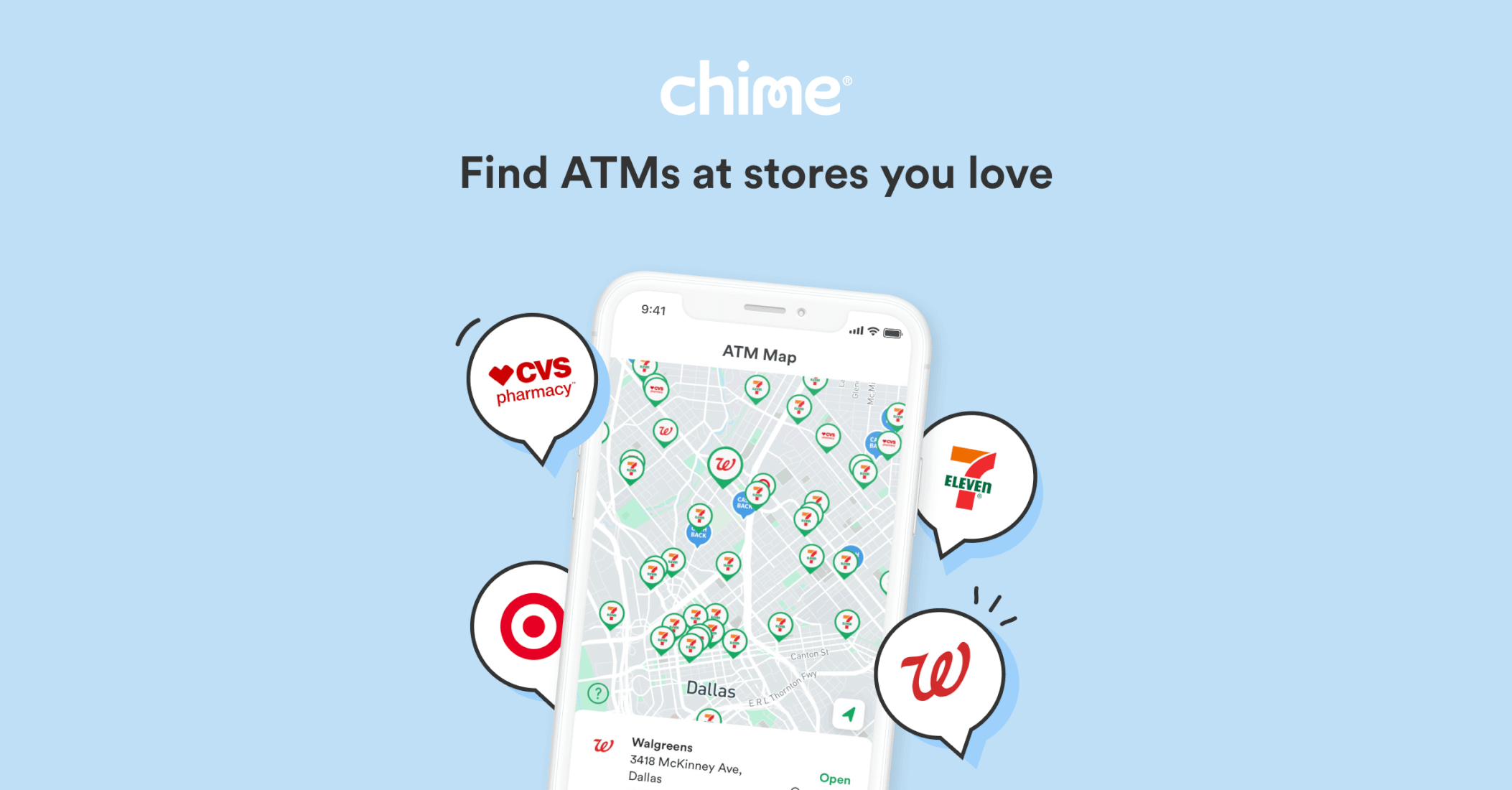

Banks and Credit Unions -- You can request a cash withdrawal by going into a bank or credit union and presenting your Chime Visa.

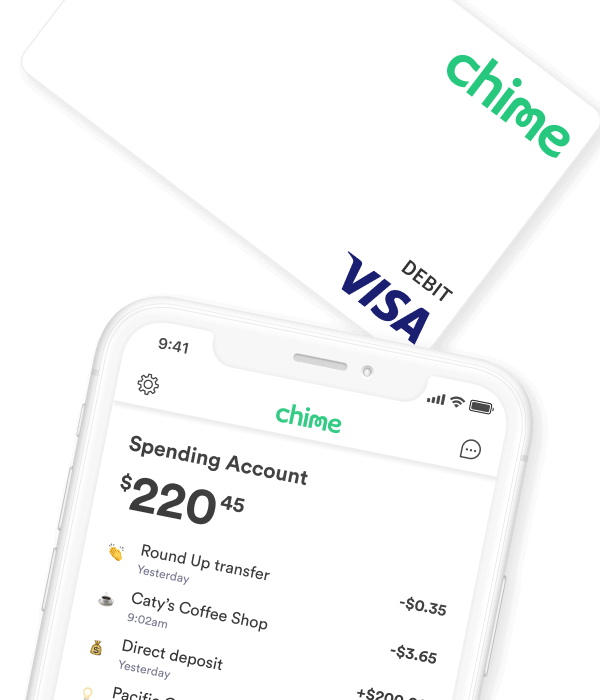

. Chime makes its money primarily by collecting interchange fee from Visa every time you use your card. You can also use your. The following are the various ways in which you can move money off of the Chime Credit Builder Card.

Here are the most important rates and fees you should know after reading our Chime review. Chime is a financial technology company that provides many benefits to its members such as a Chime Visa. If you want to withdraw money from an ATM using your credit card follow these steps.

They issue credit cards and some other cardless services. This is referred to as an Over-The. Log in to the Chime bank app or their official website with your details.

Can I withdraw 5000 from Chime. The Chime daily ATM withdrawal limit Counter is set to 500 per day. Because you have to settle any outstanding.

Chime is not a credit card. Debit card automated savings and even credit-building. How do I withdraw large amounts from chime.

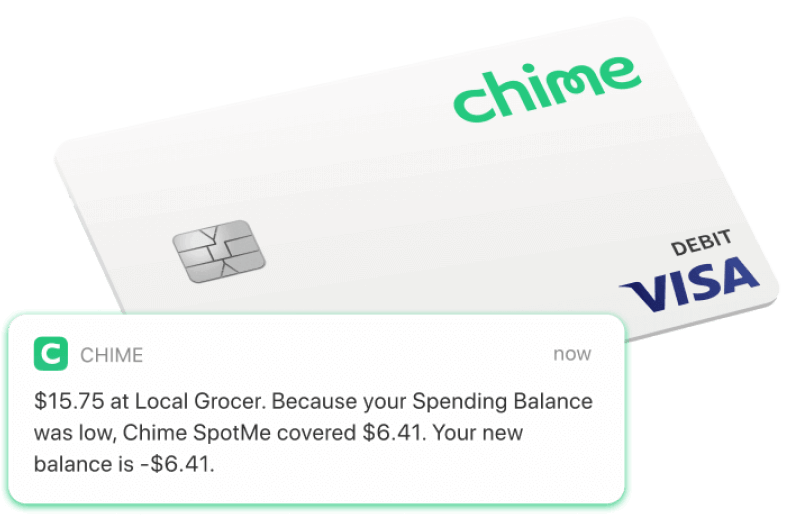

Can a Chime card be used as a credit card. Chime also makes money from ATM withdrawals. The Chime prepaid cards daily withdrawal limit is 500 at any ATM.

Just go through the steps below. You can also withdraw cash by going into a bank or credit union and presenting your card to the teller. However there are some.

19 2021 Published 808 am. Banks and Credit Unions -- You can request a cash withdrawal by going into a bank or credit union and presenting your Chime Visa Debit. Chime is an online bank that offers many benefits to its members such as a Chime Visa debit card automated savings and credit-building tools as well.

The online bank Chime offers spending accounts with debit cards accepted wherever Visa debit cards are accepted. Banks and Credit Unions. Can I withdraw from my Chime Credit Builder card.

Once youve successfully logged in go to the Chime. Chime is a financial technology company that offers a secured credit card called Chime Credit Builder. How to Use Your Credit Card at the ATM.

Insert your credit card into the ATM. The Card Purchase limit both Chime Credit card limit and debit is up to 2500 a day. No Chime doesnt offer cardless ATM withdrawals meaning you cannot withdraw money from Chime if you dont have your debit card on you.

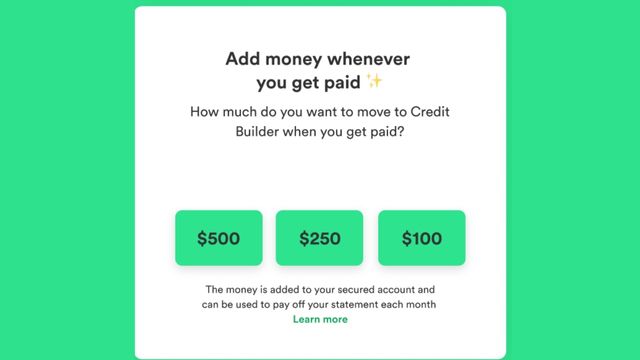

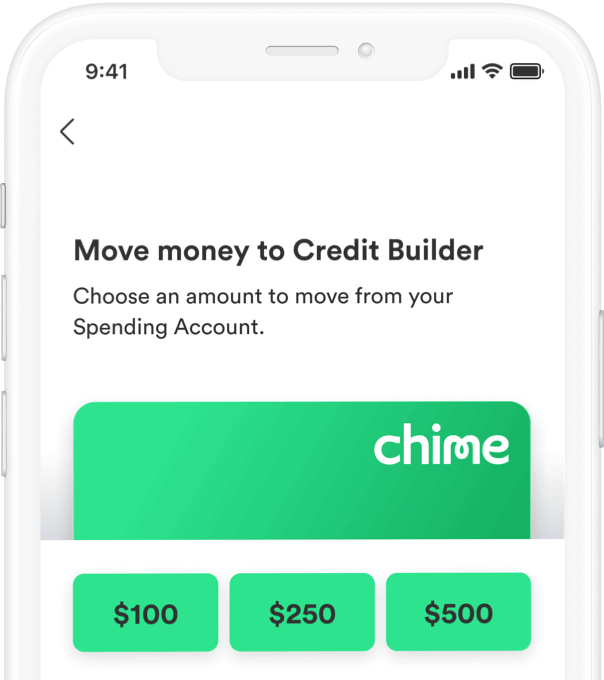

Launch the Chime app and select the Move Money tab from the appears. The Chime Transfer limit starts at 200 per day and is. No Chime doesnt offer cardless ATM withdrawals meaning you cannot withdraw money from Chime if you dont have your debit card on you.

You can move money from your Chime Credit Builder secured account back into your Chime Spending Account. You can request a cash withdrawal by going into a bank or credit union and presenting your Chime Visa Debit Card to the teller. Chime is a technology company offering financial help in transactions and money withdrawal through its services.

A downside of Chime is.

How To Move Money From Chime Credit Builder Card

Chime Savings Account All You Need To Know About It 2021

Credit Builder Basics Everything You Need To Know Chime

Answers Chime Credit Builder Card And Spot Me Michael Ryan Money

Chime Credit Builder A New Way To Build Credit

Chime Credit Builder Card Review A Secured Card With Guardrails

Chime Cardless Atm How To Withdraw Money From Chime Without Card

How To Transfer Money From Chime To Cash App Without Debit Card How Long Frugal Living Personal Finance Blog

Chime App Review What We Like What We Don T Tom S Guide

4 Ways To Withdraw Money From Chime Without Your Card

Credit Builder Card R Chimebank

Credit Builder Basics Everything You Need To Know Chime

Does Chime Work With Cash App Retirepedia

Chime Banking With No Monthly Fees Fee Free Overdraft Build Credit

Chime Our Credit Builder Card Has This Thing Called Safer Credit Building Which Uses The Money You Put In To Pay Your Monthly Charges To Make Sure This Is On Tap